FinCEN Requires Borrego Springs, CA Businesses to Submit BOI Reports by 01/01/2025 to Avoid Daily Fines

The Corporate Transparency Act (CTA) mandates that businesses in Borrego Springs, CA, disclose Beneficial Ownership Information (BOI) to FinCEN to enhance transparency and fight financial crimes like tax evasion and money laundering.

As of today, 11-26-2024, Borrego Springs business owners have 36 calendar days (or 27 business days) left to file their BOI reports with FinCEN—don't wait, or you could face $500-per-day fines!

Steps to Stay Compliant

1. Determine Your Filing Obligation

Deadline: ASAP

Most corporations, LLCs, and similar entities must file unless exempt. Exemptions include banks, nonprofits, and publicly traded companies.

2. Identify Your Beneficial Owners

Deadline: 12-10-2024

Beneficial owners are individuals who either:

-

Hold 25% or more ownership, or

-

Exercise significant control over the business.

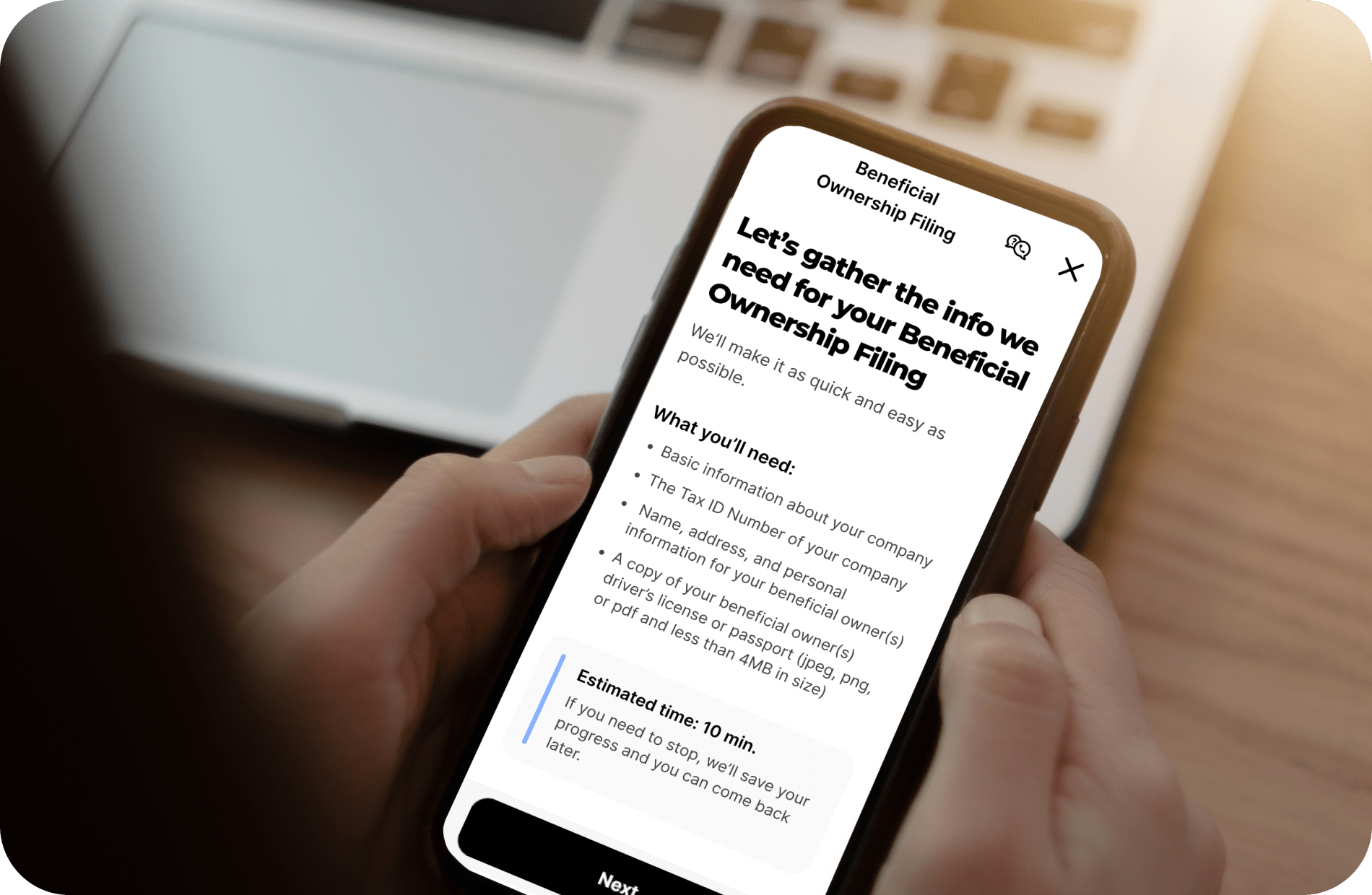

3. Gather Required Information

Deadline: 12-17-2024

Prepare the following:

-

Business Info: Legal name, EIN, and address.

-

Owner Info: Names, addresses, birthdates, and valid ID information.

4. File the BOI Report

Deadlines:

-

Existing businesses: File by 01/01/2025.

-

New businesses (2024): File within 90 days of formation.

-

New businesses (2025+): File within 30 days of formation.

Click here to learn how ZenBusiness can assist with your BOI report.

Key Information for Borrego Springs Businesses

Who Needs to File?

Businesses such as LLCs and corporations are considered “reporting companies.” Exemptions include banks, large public companies, and charities. For instance, a family-owned landscaping business in Borrego Springs would likely need to file, while a local nonprofit animal rescue would be exempt.

What is a Beneficial Owner?

A beneficial owner is anyone who either:

-

Owns 25% or more of a company, or

-

Has substantial control over its operations.

Example: If a Borrego Springs real estate agency has three co-owners and one controls 30% of the business, that individual qualifies as a beneficial owner.

What Information is Needed?

To complete your BOI filing, you’ll need:

-

Business Details: Name, EIN, and address.

-

Owner Details: Names, residential addresses, dates of birth, and ID information like a driver’s license or passport.

How and When to File

All BOI reports must be filed electronically through FinCEN’s online system. Filing deadlines are based on the company’s formation date:

-

Companies formed before 01/01/2024 must file by 01/01/2025.

-

Companies formed in 2024 have 90 days from formation to file.

-

Companies formed after 01/01/2025 must file within 30 days.

Penalties for Non-Compliance

Failing to file or providing false information can result in:

-

Daily fines of $500.

-

Potential criminal charges, including imprisonment.

However, businesses have a 90-day safe harbor period to correct errors without penalties.

Why ZenBusiness is the Solution

ZenBusiness simplifies BOI compliance, ensuring timely, accurate filing while reducing stress. Save time and avoid penalties with ZenBusiness’s BOI filing service.

Additional Resources

Ensure your compliance today and protect your business from unnecessary penalties!

This Desert Deals is promoted by Borrego Springs Chamber of Commerce.